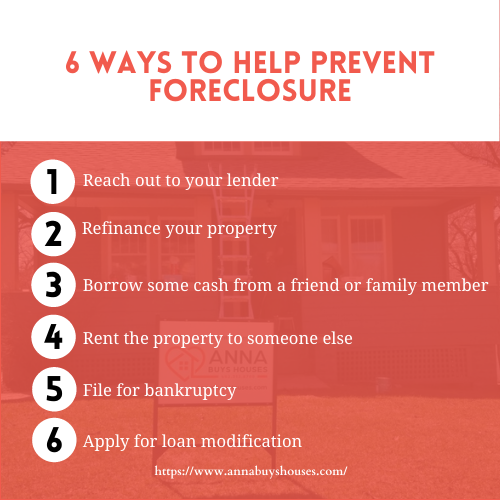

Just the word is enough to tie your gut in knots: foreclosure. The truth is, it’s heartbreaking. The very thought is painful, and the reality might be even worse. Below, we’ll present six ways on how to stop foreclosure on your Omaha house.

Foreclosure may happen to homeowners who can’t pay their mortgage payments. The legal meaning of foreclosure is letting your lender take over your property if the mortgage payments are not being paid for consecutive months. When a foreclosure occurs, they might force you to move out of your house, which can become very stressful for everyone involved. So take a deep breath. Lift your chin. Shrug off any feelings of shame or embarrassment, because foreclosure can happen to anyone. It’s not a judgment for you as a person, and it’s a problem that needs to be solved. And, we’re here for you! Keep on reading to know how to stop foreclosure on your house in Omaha.

1. Reach Out To Your Lender

As soon as you receive a foreclosure notice, it’s important to take some urgent action. Do not wait or ignore the problem; the further behind you become, the harder it will be to reinstate your loan. Reach out to your lender as soon as you notice a problem and they will give you options that can help you through difficult financial situations.

Here’s the thing: Your lender hates foreclosure almost as much as you do. The paperwork, time, and additional expenses that go along with foreclosure will cost the bank tens of thousands of dollars. They would much rather work with you to keep your loan on track.

Again, as soon as you see trouble ahead, call and ask about your options, including forbearance, reinstatement, payment plans, or loan modifications. If what they tell you seems complicated, you may ask them to break it down into simpler terms. Ask as many questions as you need to. You’re not the first person they’ve ever spoken to in this situation and they will provide you with the possible options you can take.

2. Refinance Your Property

One way to prevent foreclosure is by refinancing your Omaha property to help you achieve a lower monthly payment. But, if you choose to refinance with a hard money loan, you might get a high-interest rate. These lenders will offer loans based on the collateral’s value rather than the creditworthiness of the borrower. Hard money loans can be a solution for homeowners at the edge of foreclosure, but this can cost you more money in the long run. Another option is to communicate with your current lender to help you refinance your existing loan. However, your lender may need to assess if you can pay within the terms in the long run.

3. Borrow Some Cash From A Friend Or Family Member

For some homeowners experiencing foreclosure, borrowing some cash from family members, relatives, or friends can be a quick solution to pay the bank and prevent the foreclosure of your property. However, this isn’t a long-term solution. If you’re having difficulties paying your mortgage payments today, it might be likely that you’ll also be having difficulties paying it going forward. Borrowing cash might be a fast solution to the problem, but continuously doing this can lead to several issues such as drowning you into more debt and straining relationships.

4. Rent The Property To Someone Else

If you have an extra room or space, maybe it’s time to let it generate some income for you. Data from 2017 showed that 47% of rentals were owned by investors. Historically, it seems to make sense. With rental property, you’re letting someone else pay your mortgage, and as time goes by, your equity may grow.

The first thing you need to do is to find high-quality tenants who you can count on to pay the rent every month. Renting your home can create a steady income and may help you in paying off your monthly mortgage payment and preventing foreclosure. Even if you can’t rent the entire property, you might consider renting a room or garage.

5. File For Bankruptcy

Declaring bankruptcy is a powerful tool that can clear debt and prevent foreclosure. When you declare bankruptcy, the bank will stop collecting any payments from you and it will restructure your debt and might create a payment plan to help you get back on track.

6. Apply For Loan Modification

Federal and state laws prevent lenders from pursuing foreclosure when a loan modification review is in process. It means your lender agrees to adjust the terms of your loan to reduce the payment rate to make the loan more affordable for you.

The Making Home Affordable (MHA) Program is headed by the government to help homeowners prevent foreclosure. There are several loan modification programs that can help you reduce your monthly mortgage payments and avoid foreclosure.

Sell Your Omaha House Fast

To stop foreclosure, a direct and fast sale might be the best option to take. Working with a direct professional homebuyer may help you to close your house in Omaha quickly. They usually have on-hand cash and are ready to buy your house as soon as you want to sell your house. Preventing the bank’s foreclosure process and avoiding the destruction of your credit, selling your house to a professional home buyer like Anna Buys Houses, who are dedicated to helping homeowners in difficult situations, giving you the best solution in your current situation. While you may not receive the total retail price of your property, you’ll be able to sell and close your house in a matter of days. It may save you from agent commissions, expenses for repairs, and other holding costs. Selling your home may seem complicated, but it’s better to sell it by choice than letting the bank forcefully take over your property.

The Bottom Line: Don’t Lose Hope, There’s A Solution!

As a homeowner, it is important that you take all of the necessary steps and precautions to prevent a foreclosure from occurring. The best advice is to avoid situations that could cause one, such as excessive debt, lack of insurance, or buying a home you can’t afford. Financial setbacks could likely happen, which is why it’s important to inform your lender right away so they can help you as quickly as possible. Typically lenders aren’t interested in foreclosing on your house and will only do so as a last resort because of the overall cost and time spent on the process.

Foreclosures in Omaha, Nebraska, and throughout the United States can generally be handled in different manners. If you are facing foreclosure and want to save your home, you must consult the bank or a real estate buyer like Anna Buys Houses as soon as possible. Bankruptcy is complicated, and it takes time to prepare and finish all of the necessary documents and criteria.

If you’re currently dealing with foreclosure and need to sell your house fast, you can contact Anna at 402-313-8700, and we’ll be more than happy to assist you every step of the way.

Additional readings:

- What is a Pre-Foreclosure in Omaha?

- Understanding the Foreclosure Process in Nebraska

- Can I Sell My House in Foreclosure in Omaha?